Gold, the enchanting precious metal, has long been cherished by Indian investors for its enduring value and incredible potential for wealth creation via Digital Gold Investment and Physical Gold Investment. In a country where gold holds deep cultural and emotional significance, it also shines brightly as a stellar investment option. With its ability to preserve wealth, offer diversification, and provide a safe haven during economic uncertainties, gold has emerged as a favorite among Indian investors.

In this blog, we will explore the reasons why investing in Gold offers a golden path to financial stability and growth. We will also explore digital gold investment.

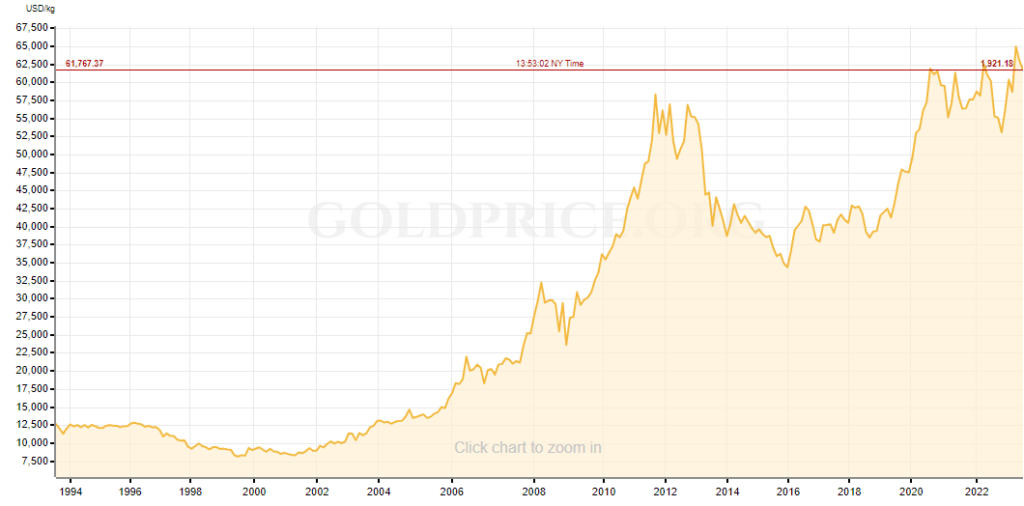

Gold investment performance over the years

Here are the estimated average annual returns for gold over various time periods:

| Time Period | Average Annual Return for Gold |

|---|---|

| Past 100 years | 4% to 5% |

| Past 50 years | 7% to 8% |

| Past 30 years | 5% to 6% |

| Past 20 years | 9% to 10% |

| Past 10 years | 7% to 8% |

| Past 5 years | 7% to 8% |

| Past 3 years | 10% to 11% |

| Past 2 years | 17% to 18% |

| Past 1 year | 12% to 13% |

| Past 6 months | 2% to 3% |

Gold prices over time (source: https://goldprice.org/gold-price-chart.html)

Gold investment performance vs other most common assets

Here are the overall Compound Annual Growth Rate (CAGR) for FD, Gold, MF, Nifty 50 and Real Estate from 2000 to 2020:

| Asset Class | CAGR (Average compounded yearly return) |

|---|---|

| FD Returns | 6.27% |

| Gold Returns | 9.13% |

| Mutual Funds Returns | 9.13% |

| Nifty 50 Returns | 8.55% |

| Real Estate | 7% |

Detailed year-wise comparison (2001-2020)

| Year | Gold Returns | Mutual Funds Returns | Nifty 50 Returns |

|---|---|---|---|

| 2001 | 2% | (-10%) | (-22%) |

| 2002 | 26% | (-12%) | (-20%) |

| 2003 | 28% | 20% – 25% | 71% |

| 2004 | (-3%) | 10% – 15% | 14% |

| 2005 | 32% | 20% – 25% | 42% |

| 2006 | 23% | 25% – 30% | 46% |

| 2007 | 31% | 35% – 40% | 54% |

| 2008 | 38% | (-35%) | (-51%) |

| 2009 | 24% | 70% – 75% | 75% |

| 2010 | 29% | 15% – 20% | 18% |

| 2011 | 32% | (-5%) | (-24%) |

| 2012 | 13% | 25% – 30% | 27% |

| 2013 | (-5%) | 8% – 12% | 6% |

| 2014 | 9% | 30% – 35% | 31% |

| 2015 | (-10%) | 5% – 10% | (-5%) |

| 2016 | 8% | 15% – 20% | 3% |

| 2017 | 2% | 20% – 25% | 29% |

| 2018 | (-5%) | (-5%) | 4% |

| 2019 | 24% | 10% – 15% | 12% |

| 2020 | 27% | (-5%) | (-8%) |

How to invest in gold in India

Now that we are convinced that Gold is a great investment option in India, you can invest in gold through the following methods:

Digital gold investment methods:

- Gold Mutual Funds: Gold mutual funds are another way to invest in gold in India. These funds invest in gold ETFs or in companies engaged in gold mining or related activities. Investing in gold mutual funds provides diversification and professional management.

- Gold Exchange-Traded Funds (ETFs): In India, you can invest in gold through gold ETFs listed on the stock exchanges. These funds track the price of gold and allow you to invest in gold without holding physical gold. You can buy and sell gold ETFs through your DEMAT account.

Apps for Digital gold investment

Here are some apps which offer user friendly platform to get you started with your first Gold investment

Offline investment methods:

- Gold Jewelry: Buying gold jewelry is a common way to invest in gold in India.

- Gold Coins and Bars: You can purchase gold coins and bars from authorized dealers, jewelers, or banks. Look for products that carry the Bureau of Indian Standards (BIS) hallmark, which ensures the purity of the gold. Keep in mind that storing physical gold comes with additional costs and security considerations.

- Gold Deposit Scheme: Some banks in India offer gold deposit schemes where you can deposit your physical gold in return for interest or a certificate of deposit. These schemes allow you to earn interest on your gold holdings without physically selling it.

- Sovereign Gold Bonds (SGBs): The Government of India issues Sovereign Gold Bonds periodically. These bonds are denominated in grams of gold and can be purchased through scheduled commercial banks, the Stock Holding Corporation of India (SHCIL), and designated post offices. SGBs provide an opportunity to earn interest and capital appreciation.